AI Assistants Are Rewriting the Rules of Travel Distribution

What Travel Managers Need to Know — and How to Stay Ahead

Executive Summary

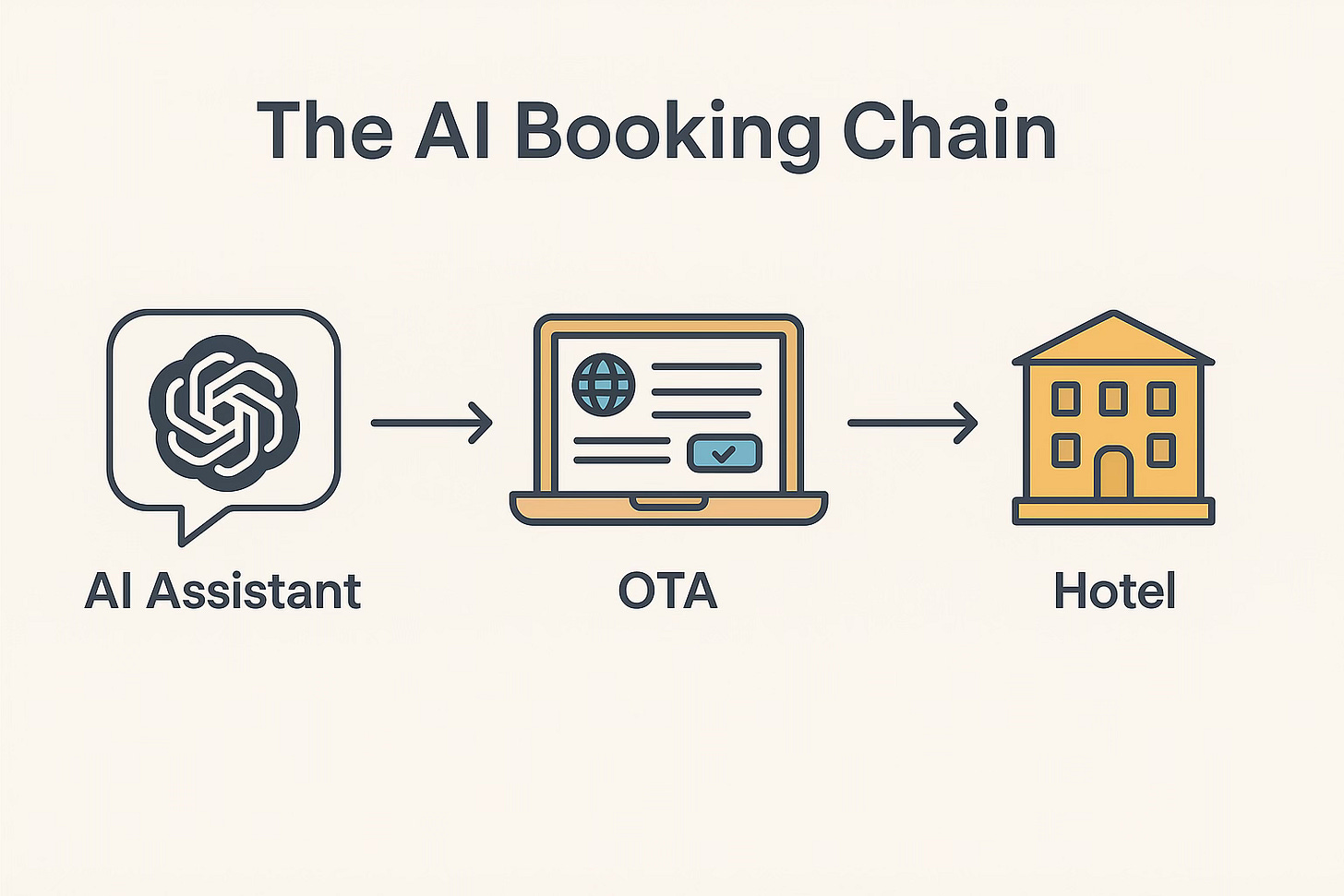

AI assistants like ChatGPT, Gemini, and Perplexity are rapidly becoming the primary booking interfaces in travel. They merge conversation, personalization, and automation—threatening to disrupt traditional OTA dominance and redefine relationships among hotels, TMCs, and corporate travel programs.

OTAs are embedding themselves into these AI ecosystems, ensuring they remain visible and influential in how travelers book. For travel managers, this means a future where algorithms—not suppliers—may control visibility, rates, and compliance.

The next three years (2025–2028) will be pivotal. Travel programs that adapt early will lead on efficiency, cost transparency, and traveler satisfaction.

AI Assistants: The New Interface for Travel Booking

AI assistants are evolving into the front door of travel. They remember traveler preferences, compare across suppliers, and can execute bookings within seconds.

The result? Frictionless booking journeys that bypass traditional OTA screens altogether.

“Book me a 3-night stay in Chicago under $250, near the office.”

— This one sentence replaces hours of browsing.

For travel managers: this means policies and visibility must adapt to conversational, decentralized booking.

🟢 Tip: Begin tracking how employees use AI tools. Establish governance guidelines before leakage grows.

OTAs Fight Back: Embedding in AI Ecosystems

OTAs like Booking.com and Expedia are forging partnerships with AI platforms to ensure they’re built into tools like ChatGPT and Gemini.

This means that even as travelers use AI, OTAs still control the inventory and take commissions.

But this embedding strategy also creates digital gatekeepers — algorithms that determine hotel visibility, pricing, and even which brands appear in conversation.

🟢 Travel Manager Tip: Choose partners who disclose how their listings integrate with AI systems. Demand transparency in ranking and rate sourcing.

Hotels Under Pressure: The Visibility Challenge

For hotels, AI-driven distribution is a double-edged sword:

More exposure through new AI channels

But higher dependency on intermediaries

Key risks:

OTA-aligned algorithms could favor big brands.

Direct channels lose prominence.

Guest data and relationships erode.

🟢 Hotel Strategy Tip:

Invest in AI-compatible APIs and CRM systems.

Advocate for fair algorithmic visibility under digital market regulations.

TMCs: From Agents to AI Ecosystem Managers

AI’s automation threatens the traditional role of TMCs—but also opens new opportunities.

Leading TMCs like Amex GBT and BCD Travel are investing in AI copilots that automate policy enforcement, risk management, and predictive insights.

🟢 Travel Manager Tip:

Select TMC partners that:

Integrate with leading AI ecosystems

Provide policy compliance analytics in real time

Offer visibility into how their AI tools manage bookings

The 2026–2028 Outlook: AI vs. OTAs

Experts predict that by 2026–2028, AI assistants will begin bypassing OTAs—directly connecting with hotels via open APIs.

This will reduce commissions but heighten competition for visibility.

Key drivers:

Cost pressure to eliminate intermediaries

Rapid tech adoption by hotel chains

Traveler demand for fair, bias-free recommendations

However, fragmentation in hotel systems means full disintermediation will take time. Expect a hybrid phase—AI still using OTAs as partial data sources until standards evolve.

🧭 Alternate View: Why AI May Stay an IntermediaryNot everyone agrees that AI assistants will own the entire booking journey.

There’s a compelling case that platforms like ChatGPT, Gemini, and future AI tools may choose not to manage direct bookings — even if they could.

Handling bookings introduces real-world complexity: payments, cancellations, refunds, and customer service — all outside the core model of AI providers focused on intelligence and interface design.

A good comparison is Google’s path in the 2010s.

Despite controlling most travel search traffic, Google never became a full OTA. Instead, it monetized visibility — letting OTAs and hotels handle transactions. The reason was simple: travel booking operations didn’t align with Google’s scale-efficient model.

AI assistants might follow the same logic, staying as orchestrators rather than operators.

If that happens, the power shift won’t be about who processes bookings — but about who controls visibility and influence inside the algorithm.The Travel Manager Playbook

In this new landscape, inaction is the biggest risk.

Top 5 Actions for 2025:

Monitor AI adoption among travelers and suppliers.

Audit your hotel program visibility in AI-driven search results.

Align with forward-thinking TMCs that embrace automation.

Demand algorithmic transparency from all suppliers.

Engage in industry advocacy for fair AI standards.

Ignoring these steps could expose your travel program to hidden costs and lost control over data and traveler experience.

Conclusion: Travel’s AI Future Is Already Here

AI assistants are not the future—they’re the present shift in travel distribution.

The balance of power between OTAs, TMCs, hotels, and corporate buyers is being rewritten by algorithms that decide who gets seen and booked.

For travel managers, the challenge is clear:

Adopt, govern, and lead — before AI platforms redefine your travel policy for you.

The time to prepare isn’t next year — it’s before your travelers start saying, “Hey ChatGPT, book my next trip.”

References

PhocusWire: AI’s New Gatekeepers: How Booking.com and Expedia Are Hijacking the Future of Travel

Hospitality Today: AI Agents Put Online Travel Giants on Edge

AltexSoft: AI Travel Agent: Could It Destroy the OTA Business Model?

BTN Europe: BCD Travel Partners with SkyLink for AI-Based Assistant

Amex GBT: Using AI for Better Business Travel